Comprehensive review of Uniswap decentralized exchange

Can Uniswap be a good alternative to centralized exchanges? In this article, we have comprehensively reviewed the decentralized exchange Uniswap.

Uniswap Decentralized Exchange Review: A Comprehensive Overview

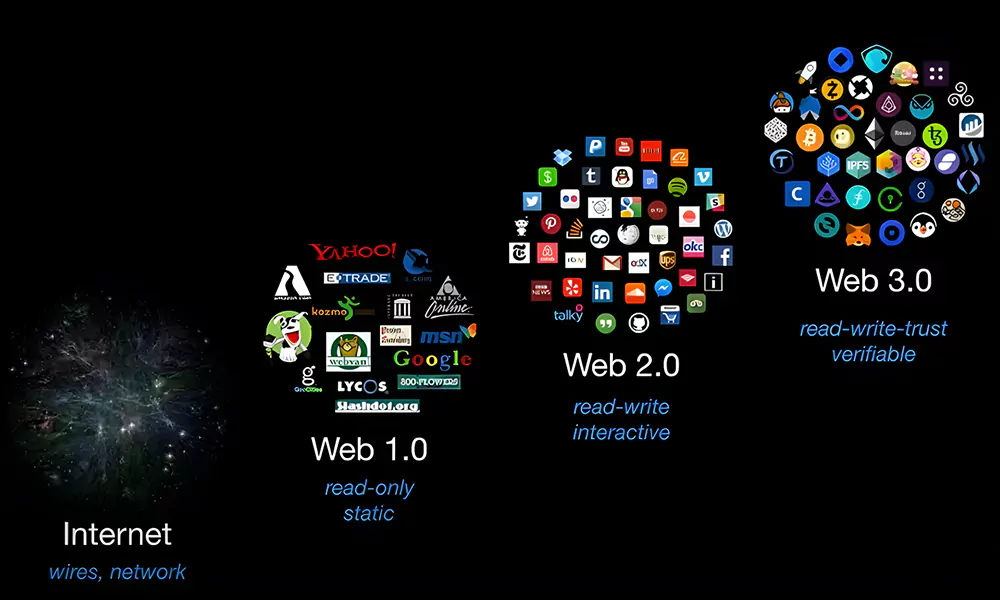

As the cryptocurrency market undergoes rapid changes, decentralized exchanges, or DEXs, have become essential components of the decentralized finance (DeFi) ecosystem.

These platforms offer unique benefits by allowing users to trade directly with one another, without the need for a central authority or intermediary.

Among the many DEXs available, Uniswap has attracted considerable attention and a large number of users. Its innovative methods for trading, providing liquidity, and managing governance processes make it a significant player in decentralized trading.

Uniswap allows users to exchange various cryptocurrencies easily, while also enabling individuals to contribute liquidity to trading pools and earn rewards for their participation.

In this article, we will explore the key features of Uniswap, such as its automated market-making model, which distinguishes it from traditional exchanges.

We will also discuss the strengths that have helped it gain popularity, including its user-friendly interface and robust security measures. However, it is important to address the challenges Uniswap faces, such as issues related to scaling, transaction fees, and competition from other platforms.

By examining these aspects, we aim to provide a detailed review that will help potential users and investors understand what Uniswap has to offer and what considerations they should keep in mind.

What is Uniswap?

Uniswap is a decentralized exchange that operates on the Ethereum blockchain. Its primary function is to enable users to trade various tokens directly from their wallets, eliminating the need for intermediaries or centralized organizations. This design allows for greater privacy and control over funds.

Uniswap was created in November 2018 by Hayden Adams. It uses a system called Automated Market Maker (AMM), which is different from the traditional order book mechanism typically found in other exchanges.

In a standard exchange, buyers and sellers place orders that match based on price and time. In contrast, Uniswap allows users to swap tokens in a more direct manner.

The Automated Market Maker approach relies on liquidity pools. These pools are smart contracts that hold funds for specific trading pairs. Users can add their tokens to these pools, which helps provide the liquidity needed for trading.

When someone wants to swap one token for another, the trade is executed using the tokens available in the pool. This system allows for quick trades and reduces the impact of price fluctuations.

Uniswap has become a popular choice for those looking to trade cryptocurrencies in a decentralized manner. Its user-friendly interface and efficient trading model attract many participants in the Ethereum ecosystem.

In this way, Uniswap contributes to the growing trend of decentralized finance, offering a new way for individuals to engage in trading without relying on traditional platforms.

Features of Uniswap

1. Automated Market Making

Uniswap's primary mechanism is Automated Market Making (AMM). This system allows users to trade tokens without relying on a central market maker. Instead of needing buyers and sellers to match trades, Uniswap utilizes liquidity pools that contain pairs of tokens. Users can deposit tokens into these pools, creating liquidity for others to use.

When users provide liquidity, they earn fees that correspond to their share of the pool. This set-up not only enables quick and efficient token swaps but also encourages more users to provide liquidity, leading to a thriving ecosystem.

2. Token Swaps

Another significant feature is the ability to conduct token swaps. Users can exchange any ERC-20 token for another with relative ease, thanks to Uniswap’s user-friendly interface. The platform's design is straightforward.

It allows both newcomers and seasoned traders to navigate it effortlessly. Users can quickly locate the token they wish to swap and view real-time exchange rates, including any slippage fees that may apply. This clarity helps users make informed trading decisions.

3. Liquidity Provision

The feature of liquidity provision stands out as a major advantage for users on Uniswap. Individuals can become liquidity providers (LPs) by depositing two tokens of equal value into a designated liquidity pool. In exchange for their contribution, LPs earn a share of the trading fees generated from the transactions that occur within that pool.

This model offers users a way to earn passive income from their cryptocurrency investments, as their assets are actively used to facilitate trades on the platform.

4. Governance Token: UNI

Uniswap also introduced its governance token, known as UNI, in September 2020. This token allows users to have a say in the future of the platform. Holders of UNI can propose changes and vote on various aspects of the protocol, such as how fees are set, what incentives might be offered for providing liquidity, and any future updates or upgrades to the platform.

This governance structure promotes decentralization, giving users a voice in the decisions that affect the ecosystem and aligning their interests with the overall health and success of Uniswap.

5. Interoperability and Layer 2 Solutions

Lastly, Uniswap is actively exploring interoperability and Layer 2 solutions to enhance its accessibility and scalability. With the growing need for efficient and cost-effective transactions, Uniswap looks to integrate with Layer 2 solutions like Optimism and Arbitrum.

These technologies aim to overcome Ethereum's scalability challenges by enabling faster and less expensive transactions. This focus on Layer 2 solutions ensures that even smaller trades can be executed efficiently, broadening the platform's appeal to a wider range of users.

Overall, Uniswap combines innovative technology with user-friendly features to create a robust platform for trading cryptocurrencies. Its unique approach to market making, liquidity provision, governance, and scalability sets it apart in the crowded decentralized finance landscape.

Strengths of Uniswap

Decentralization:

Decentralization is a core feature of Uniswap. When users engage with this platform, they retain complete control over their digital assets. This aspect reduces the risks linked to centralized exchanges, such as the potential for hacks or the poor handling of funds. Users do not have to worry about a third party mismanaging their investments, which adds a layer of security that many investors seek.

High Liquidity: Another significant advantage of Uniswap is its high liquidity. As one of the largest decentralized exchanges operating in the market, it enjoys a robust liquidity pool.

This liquidity allows users to carry out trades with minimal price slippage. In practical terms, this means that users can buy or sell assets quickly without facing large differences between the expected price and the actual price.

User-Friendly Interface: The platform also stands out for its user-friendly interface. Uniswap is designed with simplicity in mind, making it accessible for individuals with varying levels of experience. New users can navigate the platform with ease, while more experienced traders can take advantage of its advanced features without feeling overwhelmed.

Continuous Innovation: Lastly, Uniswap's commitment to continuous innovation keeps it at the forefront of the decentralized finance space. The platform is constantly developing and releasing updates to improve its functionality.

The launch of Uniswap v3 is a recent example, introducing new features that enhance the overall user experience. These ongoing improvements show that Uniswap is dedicated to staying relevant and providing value to its users.

Challenges and Concerns

Impermanent Loss: Challenges and concerns associated with providing liquidity in decentralized exchanges (DEXs) like Uniswap demand careful attention. One significant risk is impermanent loss. This occurs when liquidity providers (LPs) may find that the value of their assets decreases compared to simply holding onto their tokens.

When traders swap tokens, the price ratios change, which can lead to LPs having less value than they started with. This situation requires LPs to weigh the potential rewards against the risk of impermanent loss before deciding to enter liquidity pools.

Transaction Fees: Another challenge that liquidity providers face is high transaction fees. While Uniswap offers a user-friendly experience, it operates on the Ethereum network, which can experience congestion.

During busy periods, transaction fees may skyrocket, making it costly for smaller traders to execute their trades. High fees can deter participation from users who are trying to make profitable trades in smaller amounts.

Regulatory Scrutiny: Regulatory scrutiny is also a growing concern as DEXs become more popular. As these platforms attract more users and capital, regulatory bodies are paying closer attention to their operations.

The legal rules governing cryptocurrencies and DEXs are constantly changing, which presents risks for platforms like Uniswap. This increasing oversight could lead to stricter regulations, impacting how DEXs operate and affecting the overall trading environment for users.

Conclusion

Uniswap has established a strong position as a leader in the decentralized exchange market. It provides users with unique access to cryptocurrency trading and opportunities for liquidity provision.

The platform's innovative approach utilizes the Automated Market Maker (AMM) model, which allows users to trade directly without needing a traditional order book. This model enhances efficiency and accessibility for traders.

Uniswap also features a robust governance framework that promotes user participation. Users have the power to influence the platform's direction and make decisions that affect the community. This community-driven approach fosters engagement and ensures that the interests of users are prioritized.

As the cryptocurrency market expands, Uniswap is well-positioned to attract more users seeking flexible and decentralized trading solutions. It continues to serve as a go-to platform for those interested in engaging with digital assets.

However, it is crucial for users to be aware of the risks and challenges associated with using Uniswap. Like any investment, trading carries inherent risks, and users should inform themselves about potential pitfalls.

For individuals interested in decentralized trading, Uniswap presents an innovative option that aligns with the core principles of decentralized finance (DeFi). The platform stands for transparency, accessibility, and user empowerment.

This makes it suitable for traders of all experience levels. Whether you are a seasoned trader with extensive knowledge or a newcomer just beginning your exploration of the crypto space, Uniswap is a platform worth evaluating as you navigate your trading journey.

Its combination of user control and innovative trading features ensures it remains an essential player in the growing world of decentralized finance.

Related News

Add a Comment

Please login to your account to post a comment.

Popular News

A Golden year for gold Could Bitcoin reach new price highs following gold lead?

2024-09-27 07:39:00

Meta $4.5 billion loss in the last 3 months. Metaverse bubble destruction domino activated?

2024-08-02 13:44:00

Important tips for the successful entry of inexperienced people into digital currencies

2024-03-14 10:32:00

TonKeeper Wallet Tutorial

sunswap review

comprehensive coinbase exchange review

cryptoeconomie is an independent media outlet covering the cryptocurrency industry. Its journalists adhere to a strict set of editorial policies. cryptoeconomie has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. cryptoeconomie provides essential analysis of the cryptocurrency market. Our goal is to inform, educate and share valuable information with our readers. Our editorial content is based on our passion for providing unbiased news, in-depth analysis, comprehensive cryptocurrency price charts, insightful opinions, as well as regular reporting on the social transformation that cryptocurrencies are bringing. We believe that the world of blockchain and cryptocurrencies will grow exponentially and become an integral part of our daily lives. We work every day to help educate our readers and raise awareness of the complexities and benefits offered by today’s digital revolution.

Categories

© Copyright 2025 cryptoeconomie.com . Design by: uiCookies

Comments