what is arbitrage in crypto-simple guide-with example

Unlock the secrets of crypto arbitrage with our easy guide. Find out how to earn profits using real-life examples. Dive into crypto today!

In the ever-evolving world of cryptocurrency, opportunities abound for savvy investors looking to profit from price discrepancies across different exchanges. One of the most prominent strategies that we can use to capitalize on these disparities is known as arbitrage.

In this article, we'll delve into what arbitrage is, how it works, and the various types we can engage in, along with their pros and cons.

What is Arbitrage?

At its core, arbitrage refers to the practice of buying and selling assets in different markets to take advantage of price differences. This concept isn’t new; it's been around in traditional finance for decades.

In the crypto realm, arbitrage enables us to buy a cryptocurrency on one exchange at a lower price and then sell it on another exchange where the price is higher, thus securing a profit.

A Simple Example of Arbitrage

Let’s break it down with a straightforward example:

Imagine we notice that Bitcoin (BTC) is trading for $40,000 on Exchange A. At the same time, we see that on Exchange B, Bitcoin is priced at $40,500. Here’s our opportunity: We buy 1 BTC on Exchange A for $40,000 and simultaneously sell it on Exchange B for $40,500. Profit Calculation: After deducting any transaction fees, let’s say our total profit amounts to $400.In this case, we've executed a simple arbitrage trade, making a profit just by exploiting the price differences between two exchanges.

How Does Arbitrage Work?

Arbitrage works by identifying and exploiting inefficiencies in the market. Here’s a more detailed look at the process:

1. Market Monitoring: We need to constantly monitor multiple exchanges to identify price discrepancies. This can be done manually or through automated trading bots that scan for price variations.

2. Execution of Trades: Once we spot an opportunity, we must act quickly. We buy the asset on the cheaper exchange and sell it on the more expensive one. Speed is crucial here, as the market can change rapidly.

3. Transaction Costs: It’s essential to factor in the fees associated with trading on different platforms. Our profit margins should account for these costs to ensure that the trade is still beneficial.

4. Risk Management: While arbitrage seems like a low-risk strategy, it does come with its own set of risks, including transfer delays and slippage, which can affect the potential profit.

Types of Arbitrage

Arbitrage can be categorized into several types, each with its own unique characteristics and potential benefits. Here are some of the most common forms:

1. Spatial Arbitrage

This is the classic form of arbitrage we've already discussed, where we exploit price differences across different exchanges.

Pros

Simple to understand and execute. Potential for quick profits.Cons

Requires quick execution. Fees can eat into profits.

2. Temporal Arbitrage

Temporal arbitrage involves buying and selling the same asset at different times to take advantage of price changes over time.

Pros

Can yield significant profits if timed correctly. Less dependent on multiple exchanges.Cons

Requires in-depth market analysis. Higher risk due to price volatility.

3. Statistical Arbitrage

This type uses complex algorithms to analyze statistical patterns and price movements. It’s typically more suited for advanced traders or institutions.

Pros

Can identify and exploit subtle price discrepancies. May yield consistent returns over time.Cons

Requires advanced knowledge and technology. Higher operational costs.

4. Triangular Arbitrage

This method involves trading between three different currencies in a single exchange. We exploit the differences in exchange rates between three pairs.

Pros

Can reduce exposure to market volatility. Opportunities often arise in high-volume trading pairs.Cons

Requires fast execution and precision. Complicated to execute without proper knowledge.Pros and Cons of Arbitrage

While arbitrage can be a lucrative strategy, it’s essential to understand the potential advantages and disadvantages before diving in.

Pros

Low-Risk Strategy: In theory, arbitrage is relatively low-risk compared to other trading strategies. Profit Potential: We can make profits quickly if we act on price discrepancies efficiently. Market Efficiency: By engaging in arbitrage, we contribute to the overall efficiency of the market.Cons

Transaction Fees: These can reduce profit margins significantly, especially if trades are not large enough. Market Volatility: Rapid price changes can negate the potential for profit if we aren’t fast enough. Complexity: For more advanced types of arbitrage, the strategies can become complicated and require a deep understanding of market dynamics.FAQs About Arbitrage in Crypto

Q1: Is arbitrage legal in cryptocurrency?

A1: Yes, arbitrage is legal in most jurisdictions as long as we comply with the regulations governing cryptocurrency trading in our region.

Q2: Do I need special tools for arbitrage?

A2: While not strictly necessary, using trading bots and price tracking tools can significantly improve our efficiency and profit potential.

Q3: Can beginners engage in arbitrage?

A3: Absolutely! Beginners can start with spatial arbitrage, as it’s straightforward and requires basic knowledge of trading.

Q4: How do I find arbitrage opportunities?

A4: We can use cryptocurrency price tracking websites or arbitrage calculators that show price differences across exchanges.

Q5: What are the risks involved in arbitrage?

A5: The main risks include transaction delays, slippage, and sudden price fluctuations that can erase potential profits.

Conclusion

Arbitrage in cryptocurrency presents an exciting opportunity for us to profit from market inefficiencies. By understanding the various types of arbitrage, their pros and cons, and how they work, we can position ourselves to make informed trading decisions.

As with any investment strategy, diligent research, and careful risk management are key to success. Happy trading!

Related News

Add a Comment

Please login to your account to post a comment.

Popular News

A Golden year for gold Could Bitcoin reach new price highs following gold lead?

2024-09-27 07:39:00

Meta $4.5 billion loss in the last 3 months. Metaverse bubble destruction domino activated?

2024-08-02 13:44:00

Important tips for the successful entry of inexperienced people into digital currencies

2024-03-14 10:32:00

TonKeeper Wallet Tutorial

comprehensive coinbase exchange review

cryptoeconomie is an independent media outlet covering the cryptocurrency industry. Its journalists adhere to a strict set of editorial policies. cryptoeconomie has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. cryptoeconomie provides essential analysis of the cryptocurrency market. Our goal is to inform, educate and share valuable information with our readers. Our editorial content is based on our passion for providing unbiased news, in-depth analysis, comprehensive cryptocurrency price charts, insightful opinions, as well as regular reporting on the social transformation that cryptocurrencies are bringing. We believe that the world of blockchain and cryptocurrencies will grow exponentially and become an integral part of our daily lives. We work every day to help educate our readers and raise awareness of the complexities and benefits offered by today’s digital revolution.

Categories

- NFT

- Defi

- Metaverse

- News

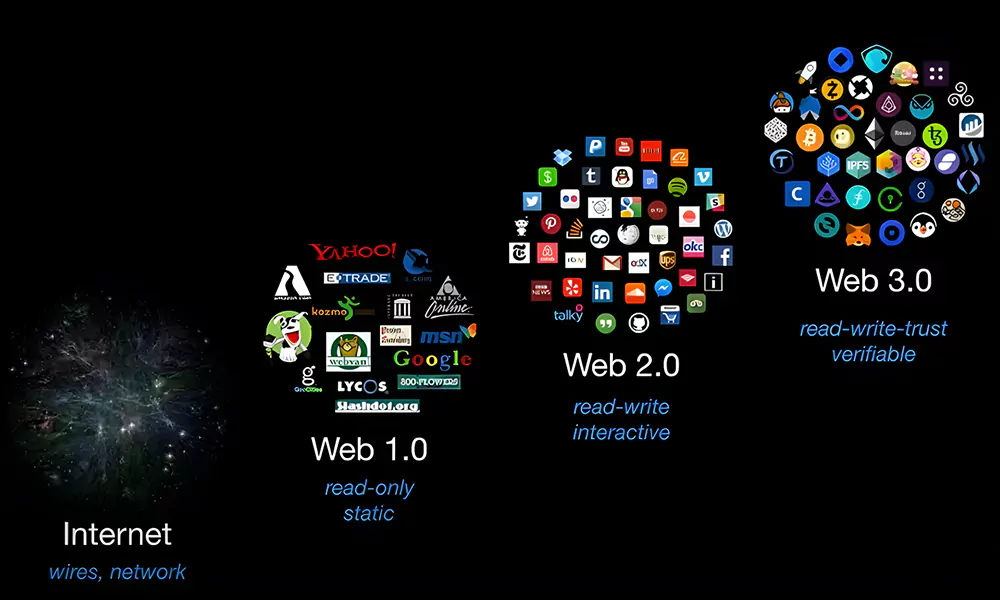

- Web3

- Crypto Exchanges News

- Stablecoins

- Altcoins

- Bitcoin

- Technologi

- Artificial Intelligence

- Crypto Learning

- Crypto Glossary

- Crypto Exchanges Training

- Ethereum

- Solana

- Regulation

- Crypto Reviews

- Centralized Exchanges

- Decentralized Exchanges

- Crypto Wallet

- Crypto Investment Training

- Trading Education

- Crypto Projects

© Copyright 2025 cryptoeconomie.com . Design by: uiCookies

Comments